Looking at powerful brand rankings is always revealing. Lots of companies like Interbrand, Brand Finance, and Kanter Brown for Wpp do annual surveys. The methodology varies on how they calculate value, but intuitively they all seem to make sense.

Looking at the best-known report from Interbrand, they present not just 2018 but a flash-back to the year 2000. The comparison between the two is downright instructive.

Scroll Down the survey to see all 75 brands

| # | Ranking 2000 | Ranking 2018 |

|---|

| 1 | Coca-Cola | Apple |

|---|---|---|

| 2 | Microsoft | |

| 3 | IBM | Amazon |

| 4 | Intel | Microsoft |

| 5 | Nokia | Coca-Cola |

| 6 | General Electric | Samsung |

| 7 | Ford | Toyota |

| 8 | Disney | Mercedes Benz |

| 9 | McDonald’s | |

| 10 | AT&T | McDonald’s |

| 11 | Marlboro | Intel |

| 12 | Mercedes Benz | IBM |

| 13 | HP | BMW |

| 14 | Cisco | Disney |

| 15 | Toyota | Cisco |

| 16 | Citi | General Electric |

| 17 | Gillette | Nike |

| 18 | Sony | Louis Vuitton |

| 19 | American Express | Oracle |

| 20 | Honda | Honda |

| 21 | Compaq | SAP |

| 22 | Nescafé | Pepsi |

| 23 | BMW | Chanel |

| 24 | Kodak | American Express |

| 25 | Heinz | Zara |

| 26 | Budweiser | J.P. Morgan |

| 27 | Xerox | Ikea |

| 28 | Dell | Gillette |

| 29 | GAP | UPS |

| 30 | Nike | H&M |

| 31 | Volkswagen | Pampers |

| 32 | Ericsson | Hermès |

| 33 | Kellog’s | Budweiser |

| 34 | Louis Vuitton | Accenture |

| 35 | Pepsi | Ford |

| 36 | Apple | Hyundai |

| 37 | MTV | Nescafé |

| 38 | Yahoo | eBay |

| 39 | SAP | Gucci |

| 40 | IKEA | Nissan |

| 41 | Duracell | Volkswagen |

| 42 | Philips | Audi |

| 43 | Samsung | Philips |

| 44 | Gucci | Goldman Sachs |

| 45 | Kleenex | Citi |

| 46 | Thomson Reuters | HSBC |

| 47 | AOL | Axa |

| 48 | Amazon | L’Oréal |

| 49 | Motorola | Allianz |

| 50 | Colgate | Adidas |

| 51 | Wrigley | Adobe |

| 52 | Chanel | Porsche |

| 53 | Adidas | Kellogg’s |

| 54 | Panasonic | HP |

| 55 | Rolex | Canon |

| 56 | Hertz | Siemens |

| 57 | Bacardi | Starbucks |

| 58 | BP | Danone |

| 59 | Moët Chandon | Sony |

| 60 | Shell | 3M |

| 61 | Burger King | VISA |

| 62 | Smirnoff | Nestlé |

| 63 | Barbie | Morgan Stanley |

| 64 | Heineken | Colgate |

| 65 | The Wall Street Journal | Hewlett Packard |

| 66 | Ralph Lauren | Netflix |

| 67 | Johnnie Walker | Cartier |

| 68 | Hilton | Huawei |

| 69 | Jack Daniels | Santander |

| 70 | Armani | Mastercard |

| 71 | Pampers | KIA |

| 72 | Starbucks | FedEx |

| 73 | Guinness | PayPal |

| 74 | Financial Times | Lego |

| 75 | Benetton | Salesforce |

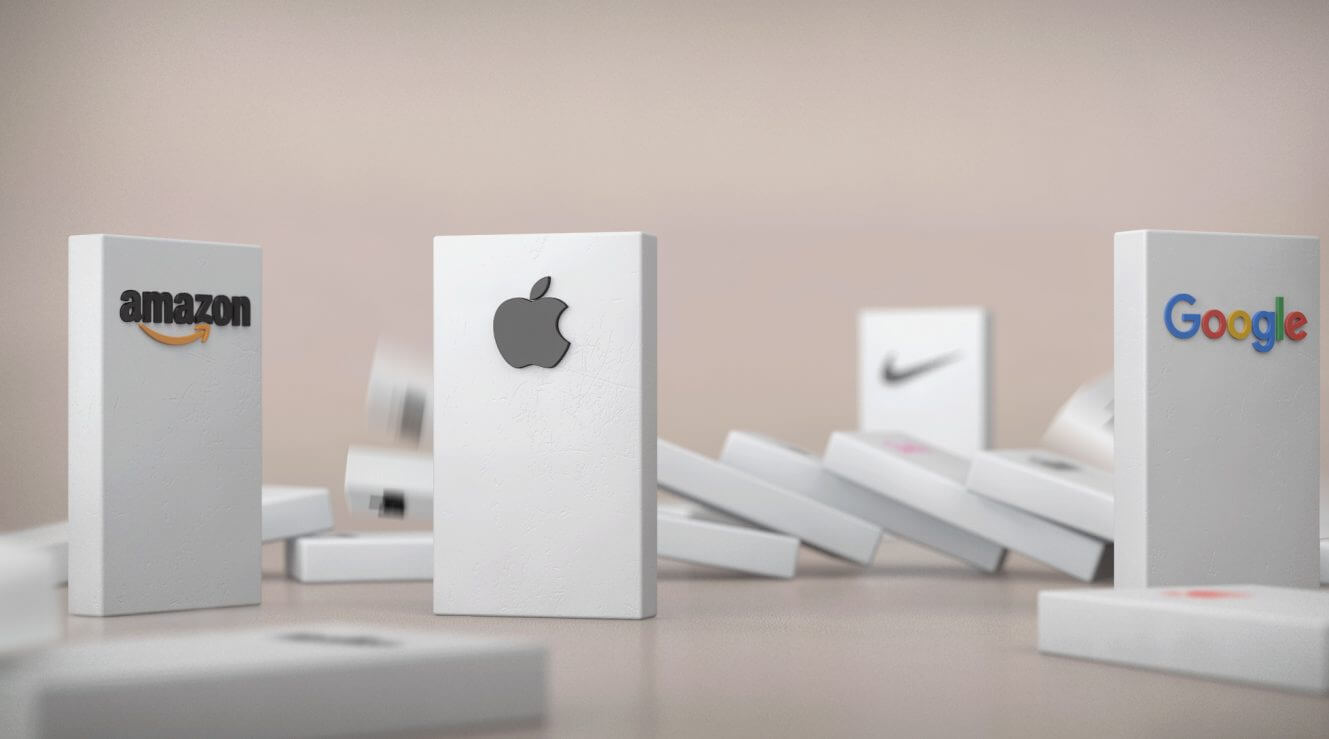

Atop the 2018 survey, are the usual suspects, Apple, Google, Amazon, Microsoft and Coca-Cola. Then as you scroll down the list, you see that 38 brands (+ 50%) of the list were not present in 2000. Some are new companies, mostly in technology like Netflix, Facebook, Huawei, eBay and PayPal but others are traditional brands that have discovered new ways to market their product and service and achieved greater saliency like UPS, Porsche and Lego.

On the downside, there are 38 brands that are no longer present in the 2018 ranking: Motorola, Thomson Reuters, Xerox, Dell, AT&T, Yahoo, Nokia, Compaq and AOL. Some like Compaq and Kodak no longer exist. Others lost brand power because they were overtaken by technology: Yahoo by Google; Others lost social relevancy like Barbie and Marlboro.

Here are some observations on what some brands have done to maintain their standing or not done, and consequently lost it:

-

- Relevancy: LEGO, 74th on the 2018 list was not present in 2000 despite being founded in 1949! LEGO reenergized its business with licensing deals to bring stories back to standard brick play. Blockbuster movies and comic book franchises provided narratives that anyone could build upon and iconic characters to reach for in store. Going one step further, LEGO Ideas became an interactive platform that invited fans to create, crowdsource and vote on user-generated product ideas with the chance of seeing their own LEGO idea on shelves. LEGO has transcended the block building business and evolved into the story business, creating an army of LEGO storytellers.

-

- Implication: Think beyond the functional bounds of your offering.

-

- Denial: Kodak # 24 and Nokia #5 in 2000. Both were market leaders in their respective categories. Both invested heavily in research and innovation, but at a critical moment refused to acknowledge or act upon what the data was telling them. In Kodak’s case it was the technology sea change from film to digital cameras while in Nokia’s case it was the paradigm shift from hardware to software, which allowed Apple (ios) and Samsung (Android) to crush Nokia and take their share from 22% to less than 3%. Kodak fared even worse going bankrupt and being sold off for parts. Both are gone from the top 75 list.

-

- Implication: You do research, listen hard to what it says.

-

- Brand extensions: Porsche #52 was a venerable niche automotive brand that owned the performance positioning for over 50 years with the stellar 911, Cayman and Boxster products. The trouble was, that line-up restricted their appeal to drivers who wanted an incredible ride with virtually no back seat. So, over the past two decades Porsche carefully transferred that performance and quality equity to two new SUV lines: Cayenne and Macan and a sedan: Panamera. Customer response was initially skeptical. The purists felt the brand was being diluted, but over time, Porsche proved that the new models truly could perform like a Porsche so the brand attracted a whole new cohort who wanted Porsche performance in a vehicle more suited to their driving needs.

-

- Implication: If you use your brand halo carefully, you can succeed.

These are but three lessons that come from the evolution of 75 brands over 18 years, each one teaching us what can be done or not done, to remain a valuable brand.

For the past 30 years, Yield has been successfully managing brands for over 185 clients in 20 different sectors from discount retail, to automotive, to asset management and not-for-profit associations.

If you would like to learn more about how Yield could help you with a branding challenge, please reach out to me at:

tnation@yieldbranding.com, or 416-588-4958 x 245

Ted Nation